Hyperinflation is inflation that is out of controlHyperinflation is inflation that is “out of control”, a condition in which prices increase rapidly as a currency loses its value. Formal definitions vary from a cumulative inflation rate over three years approaching 100% to “inflation exceeding 50% a month.” In informal usage the term is often applied to much lower rates. As a rule of thumb, normal inflation is reported per year, but hyperinflation is often reported for much shorter intervals, often per month. The definition used by most economists is “an inflationary cycle without any tendency toward equilibrium.” A vicious circle is created in which more and more inflation is created with each iteration of the cycle. Although there is a great deal of debate about the root causes of hyperinflation, it becomes visible when there is an unchecked increase in the money supply or drastic debasement of coinage, and is often associated with wars (or their aftermath), economic depressions, and political or social upheavals. The main cause of hyperinflation is a massive and rapid increase in the amount of money, which is not supported by growth in the output of goods and services. This results in an imbalance between the supply and demand for the money including currency and bank deposits accompanied by a complete loss of confidence in the money, similar to a bank run. Enactment of legal tender laws and price controls to prevent discounting the value of paper money relative to gold, silver, hard currency, or commodities, fails to force acceptance of a paper money which lacks intrinsic value. If the entity responsible for printing a currency promotes excessive money printing, with other factors contributing a reinforcing effect, hyperinflation usually continues. Often the body responsible for printing the currency cannot physically print paper currency faster than the rate at which it is devaluing, thus neutralizing their attempts to stimulate the economy. Hyperinflation is generally associated with paper money because this can easily be used to increase the money supply: add more zeros to the plates and print, or even stamp old notes with new numbers. Historically there have been numerous episodes of hyperinflation in various countries, followed by a return to “hard money”. Older economies would revert to hard currency and barter when the circulating medium became excessively devalued, generally following a “run” on the store of value. Hyperinflation effectively wipes out the purchasing power of private and public savings, distorts the economy in favor of extreme consumption and hoarding of real assets, causes the monetary base, whether specie or hard currency, to flee the country, and makes the afflicted area anathema to investment. Hyperinflation is met with drastic remedies, such as imposing the shock therapy of slashing government expenditures or altering the currency basis. An example of the latter occurred in Bosnia-Herzegovina in 2005, when the central bank was only allowed to print as much money as it had in foreign currency reserves. Another example was the dollarization in Ecuador, initiated in September 2000 in response to a massive 75% loss of value of the Sucre currency in early January 2000. Dollarization is the use of a foreign currency (not necessarily the U.S. dollar) as a national unit of currency. The aftermath of hyperinflation is equally complex. As hyperinflation has always been a traumatic experience for the area which suffers it, the next policy regime almost always enacts policies to prevent its recurrence. Often this means making the central bank very aggressive about maintaining price stability, as is the case with the German Bundesbank, or moving to some hard basis of currency such as a currency board. Many governments have enacted extremely stiff wage and price controls in the wake of hyperinflation, which is, in effect, a form of forced savings. Because it allows them to hide their spending and avoid an obvious tax increase, governments have frequently resorted to printing money to meet their expenses. However, during hyperinflation, the monetary authorities fail to fund government expenses from taxes or by other means, because: (1) during the time between recording or levying taxable transactions and collecting the taxes due, the value of the taxes collected falls in real value to a small fraction of the original taxes receivable; (2) government debt issues fail to find buyers except at very deep discounts Theories of hyperinflation generally look for a relationship between seigniorage and the inflation tax. In both Cagan’s model and the neo-classical models, a crucial point is when the increase in money supply or the drop in basic money stock makes it impossible for a government to improve its financial position. Thus when fiat money is printed, government obligations that are not denominated in money increase in cost by more than the value of the money created. From this, it might be wondered why any rational government would engage in actions that cause or continue hyperinflation. One reason for such actions is that often the alternative to hyperinflation is either depression or military defeat. In late 2001, the Argentine peso collapsed in value. Rather than printing sufficient cash for the public to carry, which they feared would start a run on the banks, the government took the peso off its dollar peg. Many international economists predicted that they would have to get a new loan from the IMF and impose shock therapy in order to avoid hyperinflation. Currency controls were imposed, tariffs were instituted, and the economy was allowed to fall into a severe recession during which unemployment hit 25%, homelessness and crime spiraled upwards, and the poverty rate peaked at over 50%. The root cause is a matter of more disputes. In both classical economics and monetarism, it is always the result of the monetary authority irresponsibly borrowing money to pay all its expenses. These models focus on the unrestrained seigniorage of the monetary authority, and the gains from the inflation tax. In Neoliberalism, hyperinflation is considered to be the result of a crisis of confidence. The monetary base of the country flees, producing widespread fear that individuals will not be able to convert local currency to some more transportable form, such as gold or an internationally recognized hard currency. This is a quantity theory of hyperinflation. In neo-classical economic theory, hyperinflation is rooted in a deterioration of the monetary base that is the confidence that there is a store of value which the currency will be able to command later. In this model, the perceived risk of holding currency rises dramatically, and sellers demand increasingly high premiums to accept the currency. This in turn leads to a greater fear that the currency will collapse, causing even higher premiums. One example of this is during periods of warfare, civil war, or intense internal conflict of other kinds: governments need to do whatever is necessary to continue fighting, since the alternative is defeat. Expenses cannot be cut significantly since the main outlay is armaments. Further, a civil war may make it difficult to raise taxes or to collect existing taxes. While in peacetime the deficit is financed by selling bonds, during a war it is typically difficult and expensive to borrow, especially if the war is going poorly for the government in question. The banking authorities, whether central or not, “monetize” the deficit, printing money to pay for the government’s efforts to survive. The hyperinflation under the Chinese Nationalists from 1939-1945 is a classic example of a government printing money to pay civil war costs. By the end, currency was flown in over the Himalaya, and then old currency was flown out to be destroyed. Hyperinflation is regarded as a complex phenomenon and one explanation may not be applicable to all cases. However, in both of these models, whether loss of confidence comes first, or central bank seigniorage, the other phase is ignited. In the case of rapid expansion of the money supply, prices rise rapidly in response to the increased supply of money relative to the supply of goods and services, and in the case of loss of confidence, the monetary authority responds to the risk premiums it has to pay by “running the printing presses.” In the United States of America, hyperinflation was seen during the Revolutionary War and during the Civil War, especially on the Confederate side. Many other cases of extreme social conflict encouraging hyperinflation can be seen, as in Germany after World War I, Hungary at the end of World War II and in Yugoslavia in the late 1980s just before breakup of the country. Less commonly, inflation may occur when there is debasement of the coinage — wherein coins are consistently shaved of some of their silver and gold, increasing the circulating medium and reducing the value of the currency. The “shaved” specie is then often restruck into coins with lower weight of gold or silver. Historical examples include Ancient Rome, China during the Song Dynasty, and the United States beginning in 1933. When “token” coins begin circulating, it is possible for the minting authority to engage in fiat creation of currency. As noted, in countries experiencing hyperinflation, the central bank often prints money in larger and larger denominations as the smaller denomination notes become worthless. This can result in the production of some interesting banknotes, including those denominated in amounts of 1,000,000,000 or more. * By late 1923, the Weimar Republic of Germany was issuing fifty-million Mark banknotes and postage stamps with a face value of fifty billion Mark. The highest value banknote issued by the Weimar government’s Reichsbank had a face value of 100 trillion Mark (100,000,000,000,000; 100 billion on the long scale).One of the firms printing these notes submitted an invoice for the work to the Reichsbank for 32,776,899,763,734,490,417.05 (3.28×1019, or 33 quintillion) Marks. * The largest denomination banknote ever officially issued for circulation was in 1946 by the Hungarian National Bank for the amount of 100 quintillion pengo (100,000,000,000,000,000,000, or 1020; 100 trillion on the long scale). image (There was even a banknote worth 10 times more, i.e. 1021 pengo, printed, but not issued image.) The banknotes however didn’t depict the number, making the 500,000,000,000 Yugoslav dinar banknote the world’s leader when it comes to depicted zeros on banknotes. * The Z$100 billion agro cheque, issued in Zimbabwe on July 21, 2008, shares the record for depicted zeroes (11) with the 500 billion Yugoslav dinar banknote. * The Post-WWII hyperinflation of Hungary holds the record for the most extreme monthly inflation rate ever — 41,900,000,000,000,000% (4.19 × 1016%) for July, 1946, amounting to prices doubling every fifteen hours. One way to avoid the use of large numbers is by declaring a new unit of currency (an example being, instead of 10,000,000,000 Dollars, a bank might set 1 new dollar = 1,000,000,000 old dollars, so the new note would read “10 new dollars”.) An example of this would be Turkey’s revaluation of the Lira on January 1, 2005, when the old Turkish lira (TRL) was converted to the New Turkish lira (YTL) at a rate of 1,000,000 old to 1 new Turkish Lira. While this does not lessen the actual value of a currency, it is called redenomination or revaluation and also happens over time in countries with standard inflation levels. During hyper inflation, currency inflation happens so quickly that bills reach large numbers before revaluation. Some banknotes were stamped to indicate changes of denomination. This is because it would take too long to print new notes. By time the new notes would be printed, they would be obsolete (that is, they would be of too low a denomination to be useful). Metallic coins were rapid casualties of hyperinflation, as the scrap value of metal enormously exceeded the face value. Massive amounts of coinage were melted down, usually illicitly, and exported for hard currency. Governments will often try to disguise the true rate of inflation through a variety of techniques. These can include the following: * Outright lying in official statistics such as money supply, inflation or reserves. * Suppression of publication of money supply statistics, or inflation indices. * Price and wage controls. * Forced savings schemes, designed to suck up excess liquidity. These savings schemes may be described as pensions schemes, emergency funds, war funds, or something similar. * Adjusting the components of the Consumer price index, to remove those items whose prices are rising the fastest. None of these actions address the root causes of inflation, and in fact, if discovered, tend to further undermine trust in the currency, causing further increases in inflation. Price controls will generally result in hoarding and extremely high demand for the controlled goods, resulting in shortages and disruptions of the supply chain. Products available to consumers may diminish or disappear as businesses no longer find it sufficiently profitable (or may be operating at a loss) to continue producing and/or distributing such goods, further exacerbating the problem.

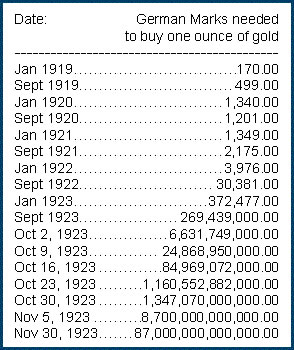

Hyperinflation chart gold to mark in 1919 to 1923 The set price for German marks to buy one ounce of gold Lets do the math to figure the percentage of hyperinflation and to see how quickly once it starts how fast money can devalue. From January of 1919 to September of 1919 the paper currency had an inflation rate of 293%. This is in just 9 months; just imagine that happening to the Dollar. The price of a gallon of gasoline is now at $2.80 with a 293% inflation rate would go up to $8.20 a gallon. From September of 1919 to January of 1920 or just three months later the hyperinflation for that one year period of 1919 was 788%. The price of a gallon of gasoline now in April of 2010 at $2.80 with a 788% hyperinflation rate would go up to $22.40 a gallon. To put 20 gallons of gas in your truck would cost $448.00. That’s probably your entire take home pay. What about food? Let’s do the math on that if you now spend $150.00 a week with a 788% hyperinflation rate it will cost you $1,182.00 to buy one week’s worth of food. It should be obvious that except for the wealthiest people in the country or the top 10% of the wage earners. No one can afford this kind of hyperinflation and wages will not be able to adjust fast enough to save anyone from this scenario. Also what about all you’re other bills like rent, electricity and credit cards? They will go unpaid and the financial system will collapse very quickly as we are talking about 90% of the population will not be able to pay their bills. We as a people can’t afford even a 100% inflation in a 12 month period. My purpose here is to show the public how quickly things can go wrong. I believe this is exactly what will happen in 2012. Allow me to explain further why this happens so quickly once it starts. First it’s our foreign trading partners where we get 70% of all our products and commodities from and they lose confidence in our paper currency. Our foreign trading partners demand more paper for their products. This forces prices up and inflation rises by that amount and very soon they start charging at an anticipated inflation rate above its current value for holding the currency until they can spend it. It’s that expectation of future inflation that forces the inflation to accelerate. Take any calculator and hit the keys 2 x 2 and see how fast it gets to one thousand. Hyperinflation works just like that. Once hyperinflation starts its impossible to stop until the currency becomes worthless. This is what Americans have to prepare for. I could show ten other examples but they all work the same way for the same reasons. Here is the bigger problem that will cause all our governments to collapse. This is the part that the liberal progressives never bothered to figure out once they collapse the economic system. We have a $1.6 trillion federal deficit for the year 2010 and in 2011 it’s supposed to be $1.3 trillion. At just a 100% inflation rate that 1.3 trillion goes to $2.6 trillion and if hyperinflation is higher than the $2.6 trillion deficits number just gets that much bigger. Government spending is not immune to inflation. Government collects more in taxes but they get 25 % while everything costs 100% more. The big question is where would we get $2.6 trillion from? We will not be able to barrow one cent of it. No one will be willing to lend us money and only a complete idiot would even think about it. This is the current situation in April of 2010. So we will just print up the paper money. This is what we are doing now but there not telling you. This is exactly what makes it even worse month by month. This is what will collapse the government and this will take a lot of explaining of exactly how it will happen. For that you will have to buy the book 2012 what’s really going to happen in 2012.

|